Cash Management

ACH & Wire Transfers

utomated Clearing House (ACH) and Wire Transfers are a fast, reliable and secure way to disburse funds, accelerate payment and collection procedures and reduce operating costs.

Automated Clearing House (ACH)

With next-day settlement, ACH allows you to improve your payment processing efficiency and accuracy and reduce expenses. We offer ACH services for businesses that want to collect funds and make payments electronically in batches through the ACH network.

Typical ACH applications include:

- Direct Deposit of Payroll

- Dividends

- Monthly Payments & Collections

Below is a list of fees associated with our ACH services:

| bizConnect Monthly Fees | $25 |

| Per entry | $0.10 |

| Per item received | $0.15 |

| Per return | $4 |

Other Fees include:

| ACH Setup | No Fee |

| ACH Rules (Required) | $40 |

| Late Filing Fee | $25 |

| Research Fee | $25 |

Wire Transfers

Peoples Bank Wire Transfer service is the most expedient method for transferring funds between your business accounts and other bank accounts. It can be used for domestic and international transactions in which no cash or check exchange is involved, but the account balance is directly debited electronically and the funds are transferred to another account in “real time.”

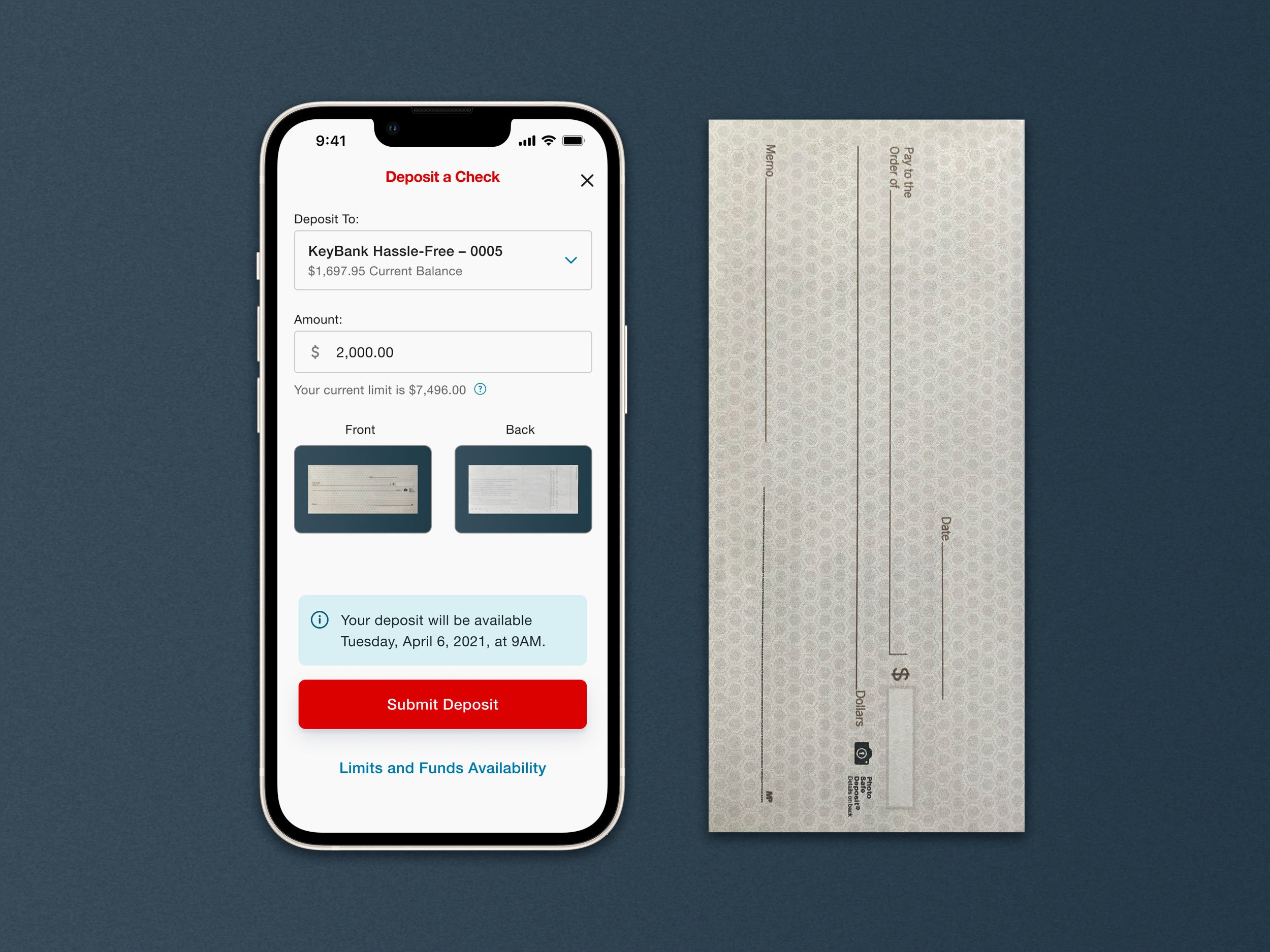

Remote Deposit

Remote Deposit is like having a 24-hour bank teller right in your office.

Remote Deposit utilizes a desktop scanner that connects to your PC and the Internet. With it you can scan checks received from customers and issue deposits electronically to the bank, anytime day or night. It’s the fastest way to turn checks deposited into cash.

Make deposits anytime*

Enjoy the convenience of making deposits electronically 24-hours a day, 7-days a week, even weekends.

Save time preparing deposits

Preparing deposits electronically is very efficient, reducing labor costs and freeing up staff for other tasks.

Cut costly courier fees or trips to the bank

Electronic deposits can reduce trips to the bank or eliminate costly courier fees.

Consolidate funds from remote locations into one bank

Check deposits can easily be made from any remote office or storefront. This streamlines your cash flow by consolidating deposits from multiple locations into a single bank.

Reduce risk of check fraud

Faster check clearing allows you to act sooner on returned checks, significantly increasing your opportunities for collection.

More secure

Multiple layers of security including password protection, Internet firewalls, and 128-bit encryption, the highest level of security available.

What you will need

Remote Deposit is easy to set up and use. All you need are the following items:

- PC with Microsoft Windows 7 or greater and a USB 2.0 port

- Peoples Bank Desktop Scanner and software

- Internet connection

- Internet Explorer 9, 10, or 11

- Peoples Bank business account

Merchant Services

Peoples Bank’s Merchant Services offers businesses a comprehensive array of electronic payment processing products and services that deliver unsurpassed value through our alliance with Higher Standards.

Credit

By opening a Merchant Services account, you can accept every major credit card at your point-of-sale (POS) including: Visa, MasterCard, American Express and Discover.

PIN-Secured Debit

We support both PIN-secured and signature-based debit transactions, which are low-cost and help you reduce fraud and increase the speed of transactions.

Check

Turn paper checks into electronic purchases right at the POS. It’s fast, secure and convenient for you and your customer.

Gift Cards

Our Gift Card program features simple-to-order standard and custom card designs.

In addition, you receive local terminal training and support, as well as customer service support 24 hours a day, 365 days a year through a toll-free telephone number. One of our business bankers can visit with you about integrated software solutions, fraud prevention and monitoring, and wireless and internet processing technology should this fit your business.

Merchant Services

Peoples Bank’s Merchant Services offers businesses a comprehensive array of electronic payment processing products and services that deliver unsurpassed value through our alliance with Higher Standards.

Credit

By opening a Merchant Services account, you can accept every major credit card at your point-of-sale (POS) including: Visa, MasterCard, American Express and Discover.

PIN-Secured Debit

We support both PIN-secured and signature-based debit transactions, which are low-cost and help you reduce fraud and increase the speed of transactions.

Check

Turn paper checks into electronic purchases right at the POS. It’s fast, secure and convenient for you and your customer.

Gift Cards

Our Gift Card program features simple-to-order standard and custom card designs.

In addition, you receive local terminal training and support, as well as customer service support 24 hours a day, 365 days a year through a toll-free telephone number. One of our business bankers can visit with you about integrated software solutions, fraud prevention and monitoring, and wireless and internet processing technology should this fit your business.

Zero Balance Account

Segregate the collection and disbursement of cash, eliminate the need for internal bank account transfers, and maximize funds available for investment or overdraft protection.

A Zero Balance Account consolidates balances from multiple collection and disbursement accounts (sub accounts) into a single master account. During the nightly posting of transactions, excess funds are either swept from the sub accounts to the master account, or from the master account to the sub accounts to restore sub accounts to a zero balance.

Home | Privacy Statement | Additional Online Privacy Safeguards | Terms & Conditions

© 2024 Peoples Bank of Commerce, All Rights Reserved.

Marketing and Website provided by SPC

Charter Office

234 East First Ave,

PO Box 592

Cambridge, MN 55008

763.689.1212